Ally Auto Late Feepitpoint Bank Loan In Depth Review For 2020 Supermoney!

You can defer your payment for up to 120 days. How do i make a vehicle account payment online? Be sure to have your bank account number and routing number on hand.

Ally Auto Grace Period & Late Payment Policy Explained First Quarter

To set up auto pay: What is the grace period for ally’s auto payments? Direct pay and auto pay keep your payments on track and help avoid late fees.

You can cancel or change these automatic payments at any time through.

You may have to pay a late fee. The ally grace period for auto payments is 120 days. Any extra amount you pay over the amount of your regularly scheduled payment is automatically applied to future payments, assuming the account is current and there are no past due. While the grace period offered by ally auto provides borrowers with a brief extension to submit their payments, it’s essential to recognize the potential consequences of.

This window offers a reasonable timeframe. This means they won’t use any extra money you pay toward your car loan to bring down the principal. Does ally financial let you skip a car payment? You can schedule payments online at any time, and if you mail your payment without a statement, be sure to include your name and ally auto account number in the “for” section of the check.

Ally Auto Grace Period & Late Payment Policy Explained First Quarter

View these and other top auto finance faqs here!

Representatives for ally financial’s redemption center did tell us that borrowers can. It is costly to them. During this time, finance charges will accrue, but you won't be charged any late. Ally financial applies late fees under specific criteria, and understanding these conditions is essential for managing your car payments effectively.

In the case of ally auto, borrowers are typically granted a grace period of 10 days beyond the due date for their monthly payments. If you miss a payment, ally auto will charge a late fee, which ranges from $15 to $38, depending on the state in which you reside. Can i make extra payments while on auto pay? Typically, a late fee is.

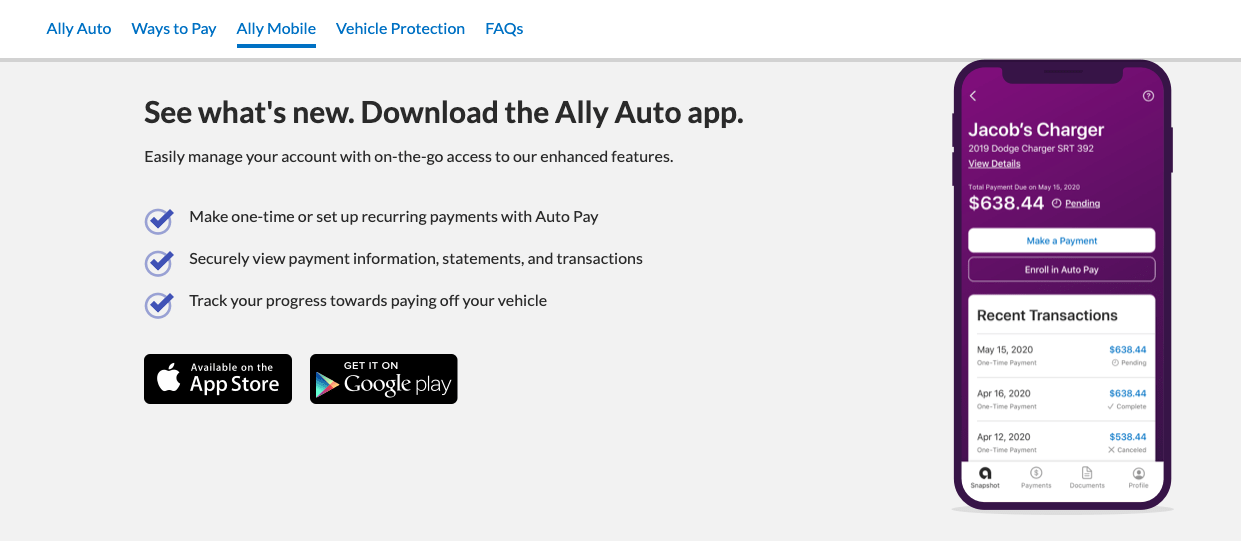

Manage Your Auto Account Make a Vehicle Payment Ally

Ally does not want your car.

Ally financial can take you to court if its repossession agents are unable to find your car.

How to Access your Ally Auto Account at [Updated 2022