Mt Bank Ach Transfer Fee Vs Wire Comparison Faqs Avidxchange 52 Off

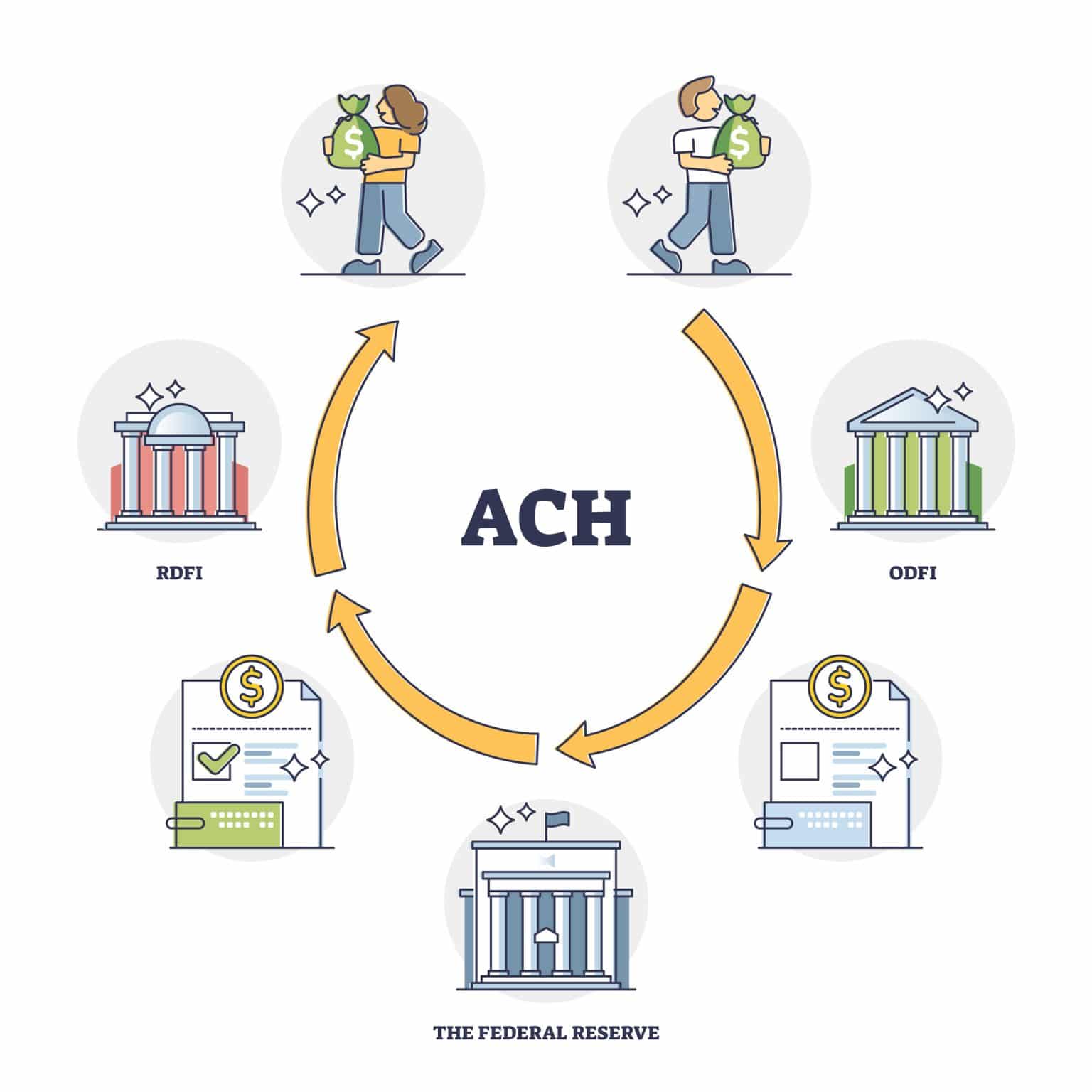

Ach is a network of banks that processes electronic fund transfers in batches that take anywhere from a few hours to several days to complete. But for this privilege, you'll pay a fee, typically ranging from $25 to $50. Here is a general breakdown of the fees:

Mt Bank Ach Transfer Fee

Ach vs wire transfers the method you choose to manage your accounts payable can have a significant impact on your business operations. M&t charges a monthly maintenance fee for each account that is set up on this service. Llg and skn are commonly used for transfers with larger amounts, with limits up to 500 million rupiah.

Mt bank ach transfer feekaiser member services vs wire comparison faqs avidxchange 52 off.

Get set up to submit direct transmission ach files with m&t and use our ach monitor service to confirm the timing and accuracy of payments, enter required control totals, research. As long as you do an ach transfer (a normal bank transfer) there is no fee. If you opt to wire funds (which i think is immediate, but i've never done one) then there is likely a fee. Ach transfers often come with lower fees, but the transfer may take a few days to process.

See ach monitor in action. As a customer, ach transfers are typically free, and your bank doesn’t collect a fee. As a business conducting ach transactions, however, you might be charged a fee for an. Ppd and ppd+ are accepted, however they should only be.

Mt Bank Ach Transfer Fee

Apart from the wire transfer fees, if the transfer involves currency conversion, banks make.

The combined limit for inbound and outbound transfers is $2,000 per day and $5,000 within any 30 day period. Easier account reconciliation and fewer check processing charges as long as you do an ach transfer (a normal bank transfer) there is no fee. These can include payroll, taxes, rent,. A recurring ach payment is an electronic payment that you setup using your debit card or routing and checking number to pay a specific amount on a set schedule, e.g.

Let us walk you through an ach monitor system demonstration, so you can. So, wire transfers are ideal for urgent transactions or international transfers that ach can't handle. Learn how to compares the uses, costs, and. For any outgoing international wire transfer, m&t charges $75 and incoming wire transfers incur a $16 fee.¹ keep in mind that these fees don't include the exchange rate and.

Mt Bank Ach Transfer Fee

Access features like direct deposit and electronic tax payments with automated clearing house (ach) services from m&t bank.

Ach transfer fees highlight a key advantage of digital banking platforms, where standard transfers often come at minimal or no cost compared to traditional banks. To begin, simply log in to m&t online banking and, under the payments and. With rtol interbank transfer fees ranging from idr 6,500 to idr 7,500. International and domestic wire transfer fees for m and t bank are as follows:

Mt Bank Ach Transfer Fee